Federal GHG Reduction Fund Programs to Spur Clean Energy Financing for Disadvantaged Communities

By Miguel Yañez-Barnuevo

September 29, 2023

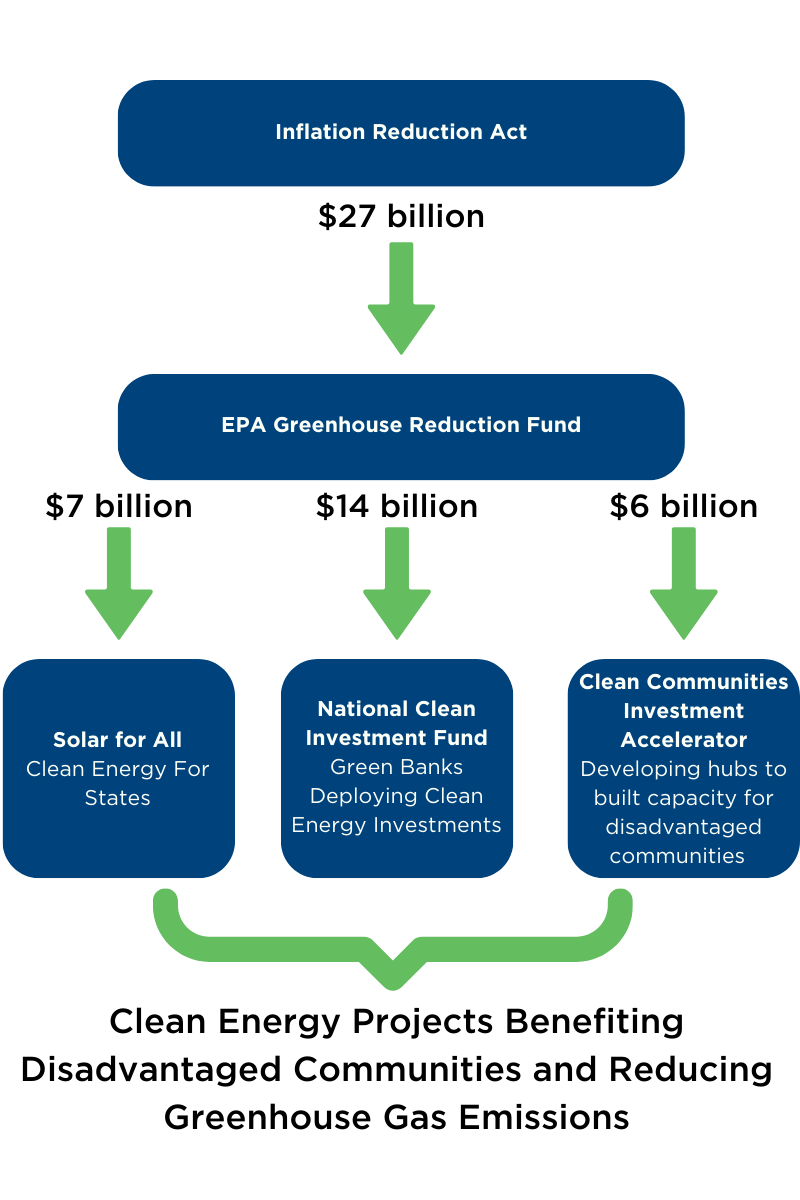

On June 28, the Environmental Protection Agency (EPA) opened the $7 billion Solar for All competition to increase solar energy access for low- and moderate-income households. Two weeks later, on July 14, the EPA launched two additional competitions—the National Clean Investment Fund and the Clean Communities Investment Accelerator. Altogether, the three competitions, which are part of the Greenhouse Gas Reduction Fund (GGRF) created by the Inflation Reduction Act (IRA), provide up to $27 billion in funding for renewable energy projects.

These three competitions aim to increase renewable energy adoption, make clean energy technologies more accessible, and improve energy affordability while reducing greenhouse gas emissions. Deploying these funds for clean energy installations will help meet President Biden’s climate goals of reducing greenhouse gas emissions by 52 percent below 2005 levels by 2030. All three competitions prioritize renewable energy investments in frontline communities historically harmed by fossil fuel industry pollution.

|

| Graphic by: Aaron Vincent Facundo |

As detailed in the IRA and consistent with the Clean Air Act, all projects funded by Solar for All and the Clean Communities Investment Accelerator must be deployed in low-income and disadvantaged communities. Section 134(a)(1) of the Clean Air Act authorizes the EPA to create a competition for states, nonprofits, and tribal governments to vie for federal funds so they can in turn provide subgrants, loans, or other forms of financial assistance to low-income communities to deploy zero-emissions technology. The goal of these competitions is to increase equitable access to distributed energy resources, like solar and energy storage.TheWhite House Council on Environmental Quality’s Climate and Economic Justice Screening Tool identifies qualifying low-income communities at the census tract level.

The EPA will accept applications for all three competitions through October 12, 2023. Winners for all three competitions will be announced in the spring of 2024 with funds to be distributed by early summer 2024.

These three competitions complement each other. The Solar for All competition supports the deployment of distributed energy and energy efficiency resources through state grants. Meanwhile, the Clean Communities Investment Accelerator increases lending capacity and resources for on-the-ground financing institutions, particularly those located in disadvantaged communities. Lastly, the National Clean Investment Fund offers low-cost financing that will flow down to local green banks or nonprofits that do not take private deposits, thereby leveraging private capital to deploy clean energy technologies. Nonprofits and tax-exempt organizations can use the IRA direct pay provision to monetize clean energy tax credits and stack them up with GGRF funds to pencil out their projects.

Solar for All Competition

The $7 billion Solar for All competition will provide 60 grants for states, nonprofits, and tribal organizations to access funds to spur on-site solar, community solar, and battery storage deployment, particularly in low-income communities. Though applications will be accepted through October 12, only applicants that have already submitted a Notice of Intent before the July and August 2023 deadlines will be eligible.

National Clean Investment Fund (NCIF)

The National Clean Investment Fund will offer grants of up to $14 billion to fund two to three national nonprofit clean energy financing entities. These entities will partner with the private sector to provide accessible and affordable clean energy financing, emphasizing disadvantaged communities. By deploying thousands of projects featuring zero-emission technologies, these entities will help reduce emissions of greenhouse gases and help achieve U.S. climate goals.

Applicants eligible to receive a grant under the National Clean Investment Fund are nonprofits that leverage private capital to deploy clean energy technologies and do not take private deposits. In other words, green banks.

Green banks offer low-interest, long-term loans to finance clean energy projects, particularly in disadvantaged communities. With their loans, green banksleverage private and public funds to provide flexible financing for families and businesses to install energy efficiency and clean energy measures, helping them lower energy bills, increase resilience, and decrease greenhouse gas emissions. Because of their structure and financial expertise, green banks are better suited to provide financing assistance for clean energy projects than traditional banks and institutions.

For the past decade, 23 green banks in 17 states have been established, providing targeted investments of more than $9 billion for clean energy technologies in rural areas, low- and moderate-income communities, as well as communities of color. More green banks are still in development.

Founded in 2011, the Connecticut Green Bank was the first green bank in the country to start offering loans and other types of financial assistance for home and business-related clean energy projects. Since its inception, the Connecticut Green Bank has mobilized more than $2.26 billion of investment by leveraging $332.4 million in green bank capital to attract about $2 billion in private investment.

“The green bank model has proven at the local and state levels across this country that a limited amount of public funds can catalyze and mobilize significant private investment in clean energy deployment to benefit disadvantaged communities,” said Bryan Garcia, president and CEO of the Connecticut Green Bank. “Alongside our green bank and local financial institution colleagues across this country, Connecticut is about to demonstrate how we can not only reduce energy burden from solar PV deployment but also increase energy security through battery storage’s inclusion in our most vulnerable communities.”

Other green banks, such as the Hawaii Green Infrastructure Authority (HGIA), have also been created to increase access to solar and other renewable technologies for low-income households.

“Thanks to the foresight and leadership of our policymakers, HGIA and other green lenders have an opportunity to access additional loan capital either directly under the GGRF’s $7 billion carve-out for state, municipal, and tribal green banks/lenders and through the $14 billion National Clean Investment Fund,” said Gwen Yamamoto Lau, HGIA’s executive director. “As a green bank, we can work as a sub-recipient alongside an eligible recipient on a long-term basis to provide non-traditional, inclusive financing to reduce carbon emissions and lower the energy cost for our most vulnerable ratepayers. GGRF capital will be leveraged with private capital to increase investments and impacts, benefiting disadvantaged communities nationwide and in Hawaii.”

Grantees can deliver financial assistance to community lenders and similar institutions for qualified projects through financial products like warehouse loans, preferred equity investments, and loan guarantees. They can also participate in loan purchasing programs that directly enable them to provide financial products to deploy qualified projects in their communities. Green banks and community lenders can also offer zero-interest loans, lines of credit, partially forgivable loans, and set up credit enhancement tools, like loan reserves and revolving loans.

These diverse sets of financial instruments help other community lenders offer low-cost and long-term financing for clean energy projects downstream, particularly in disadvantaged communities. Nonprofit grantee awardees can also offer sub-awards to established or new green banks for distributed clean energy projects for homes, businesses, schools, and nonprofits, creating a cascade effect of low-cost capital for these projects.

Clean Communities Investment Accelerator

Capitalized with $6 billion through the GGRF, the Clean Communities Investment Accelerator will provide two to seven grants to hub nonprofits, that is nonprofits or a network of nonprofits able to provide capital and leverage private capital for the development of clean energy. These hub nonprofits will in turn support local community lenders that will provide financing for clean energy projects in disadvantaged communities. Such projects will reduce greenhouse gas emissions, advance renewable energy goals, and create good local jobs by mobilizing and stimulating private capital. All funds disbursed through this competition will benefit low-income and disadvantaged communities.

Grants awarded to hub nonprofits are required to pass through to community lenders, including credit unions, green banks, community development finance institutions (CDFIs), housing finance institutions, and minority depository institutions. Then, these lenders will finance an array of eligible zero-emission projects, including distributed energy generation and storage, zero-emissions transportation, and net-zero emission buildings in disadvantaged communities.

According to Duanne Andrade, CEO of the Solar and Energy Loan Fund (SELF), "SELF is the first CDFI/green bank hybrid in the country and has been providing affordable loans for energy efficiency and resiliency to help low- and middle-income households lower energy bills and improve safety and climate resilience for over a decade. SELF leverages private funds to provide fair and inclusive financing for underbanked populations with low credit scores who need access to capital to make their homes more storm resilient, energy efficient, and sustainable. SELF has raised more than $50 million in capital, which is catalyzing $100 million in projects benefiting low and moderate-income communities. The Greenhouse Gas Reduction Funds, a part of the Inflation Reduction Act, will help SELF expand its services to help more low-income households afford energy efficiency and solar energy to improve resiliency to climate impacts such as power outages, which are becoming increasingly more frequent due to climate change."

Author: Miguel Yañez-Barnuevo

Want more climate solutions?

|

|||

|

|

|

|

Advancing science-based climate solutions

Advancing science-based climate solutions